CONSTRUCTION BOOKKEEPING INSIGHTS / JAN. 17, 2025

Is your construction business standing on a solid financial foundation—or are you building on quicksand? As we dive into 2025, it’s the perfect time to evaluate your financial footing. Without clear financials, even the most successful-looking business can collapse under mismanaged cash flow or unexpected expenses. Let’s ensure that your foundation is rock-solid.

Do you know your profit margin on your last job? How about your actual labor burden costs? If you’re unsure, you’re not alone—but it’s a dangerous way to run a business.

Financial clarity allows you to:

-

Track profitability on every project.

-

Make data-driven decisions about pricing and hiring.

-

Avoid cash flow crises.

Setting SMART goals for your business:

- Specific: Define clear objectives (ex. Increase profit margins by 5% in Q1)

- Measurable: Use metrics (ex. labor cost percentage, cash flow buffer)

- Achievable: Set realistic targets based on past performance.

- Relevant: Focus on what moves the needle (ex. cash flow, job casting)

- Time-bound: Attach deadlines to each goal.

Example of a SMART Goals:

-

Reduce invoice collection time from 45 days to 30 days by Q2.

-

Track and analyze job profitability monthly, starting now.

-

Build a 3-month cash reserve by December 2025.

Steps to building your financial roadmap:

-

Perform a Financial Inspection: Audit your current books for errors, missed costs, or inefficiencies.

-

Implement Job Costing: Ensure every expense is tied to a specific project.

-

Establish Regular Financial Reviews: Block time monthly to review cash flow, profitability, and upcoming expenses.

-

Set Milestones: Break big goals into smaller, manageable tasks.

-

Ex, By March, I'll have job costing fully implemented in QuickBooks.

-

Track Progress: Use tools like spreadsheets, QuickBooks, or project management software to stay on top of your goals.

Take Action Today:

Your financial foundation is the key to a successful 2025. Ready to uncover hidden opportunities and strengthen your business? Schedule a Financial Inspection with Hard Hats Bookkeeping today!

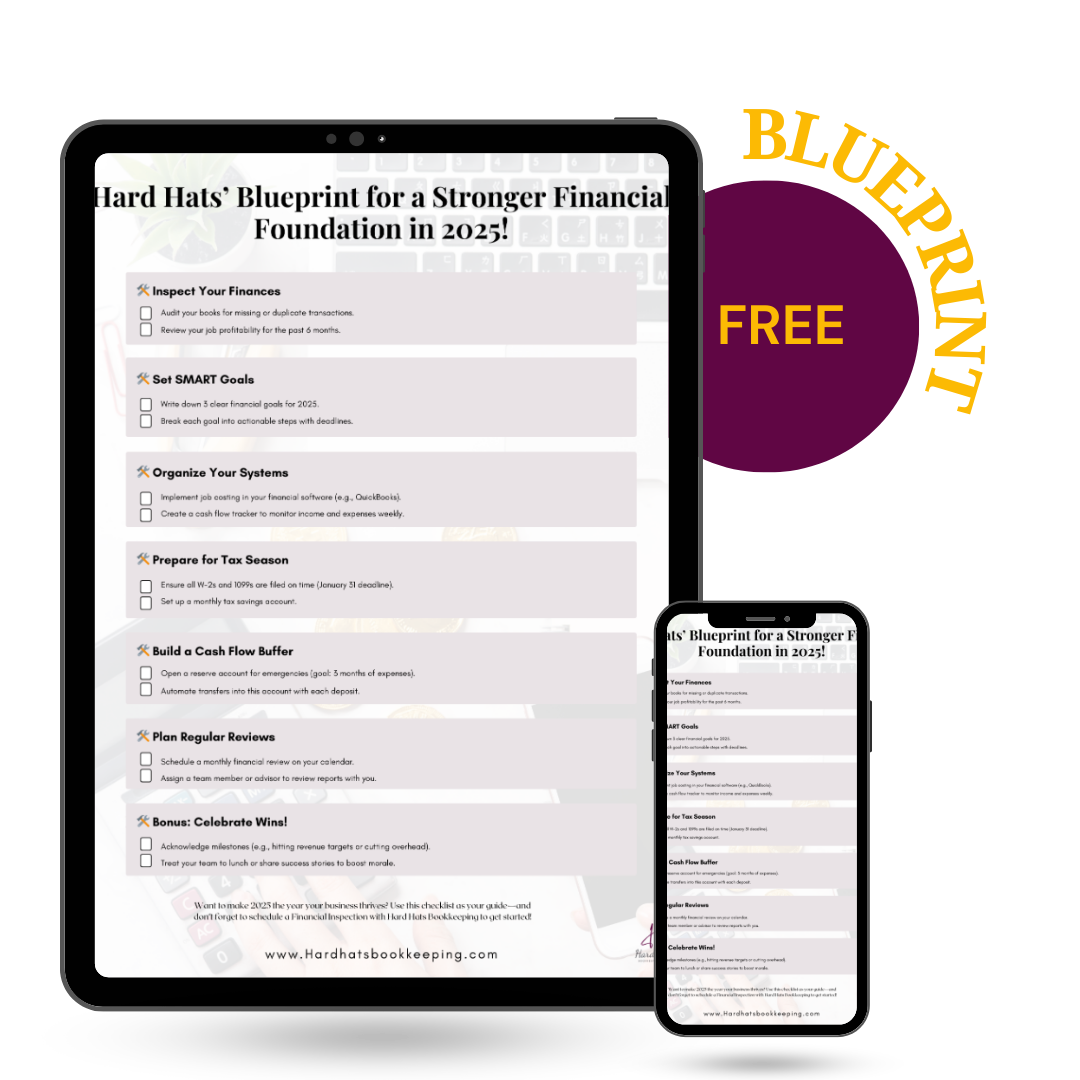

Bonus Resource:

Start building a rock-solid financial foundation for 2025. Download our free Financial Foundation Blueprint to unlock tools and tips tailored to your construction business needs. Together, we’ll pave the way for growth and success.

SHARE THIS

COMMENTS